Platform

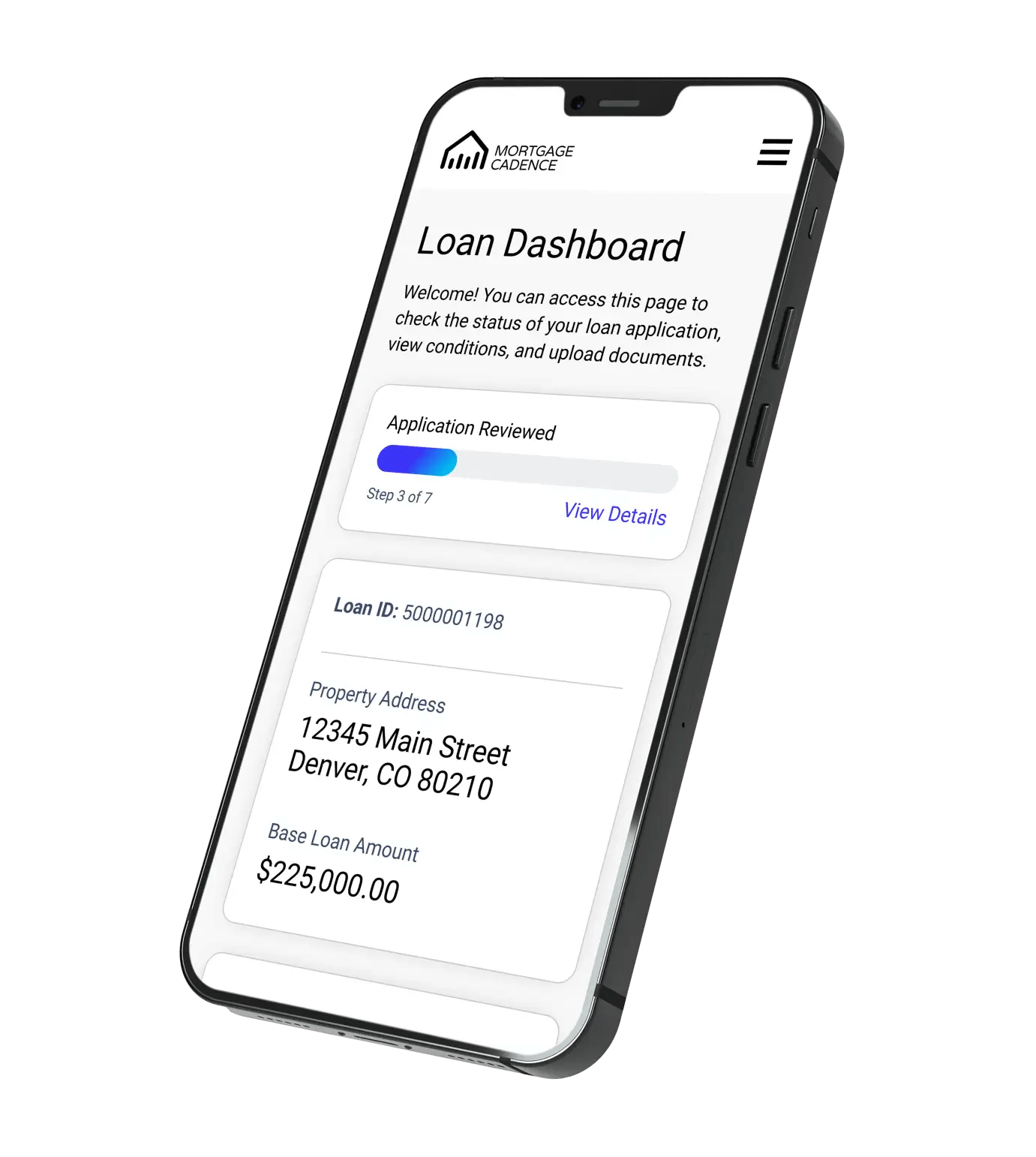

Mortgage Cadence Platform

The end-to-end Loan Origination System that delivers on the needs of your business.

Power BI

Interactive, immersive dashboards and reports for up-to-the-minute analytics.

Compliance

Implement regulatory requirements with confidence.

Quality

Leading with advanced technology and expertise to deliver quality and testing.

Solutions

Integrations

Company

Platform

Mortgage Cadence Platform

The end-to-end Loan Origination System that delivers on the needs of your business.

Power BI

Interactive, immersive dashboards and reports for up-to-the-minute analytics.

Compliance

Implement regulatory requirements with confidence.

Quality

Leading with advanced technology and expertise to deliver quality and testing.

Solutions

Integrations

Company