Aligning sales and marketing is essential to ensure both teams share goals, messaging, and effectively target customers.

Platform

Solutions

Integrations

Company

Platform

Solutions

Integrations

Company

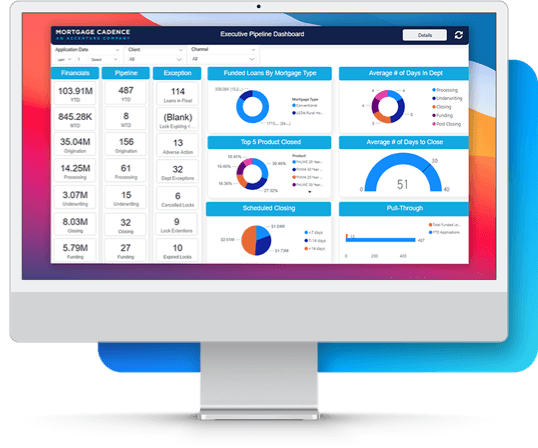

At Mortgage Cadence, we have one focus: building the best loan origination system (LOS). Offered both as a complete, out-of-the-box solution or as a highly configurable and extensible solution, the new Mortgage Cadence Platform (MCP) is designed to meet the needs of a wide range of lenders, across all products and channels.

An end-to-end LOS that includes our industry-leading point-of-sale, MCP’s open architecture provides a robust set of APIs that allow you to select niche technologies that best fit your business. MCP’s automated workflows and user interface design tools enable an easily customizable, exceptional borrower and user experience.

Cloud-Based System

MCP is a Software as a Service (SaaS) delivered platform that’s hosted in the public cloud and provides a suite of cloud-native analytics tools.

Intelligent Automation

ACE, our proprietary workflow and automation engine, provides your team with the information they need to close loans quickly and accurately.

API-Centric

Our vendor-agnostic system provides robust APIs that are easy to integrate with and support your selected providers.

Responsive Design

Designed in HTML5, MCP is browser agnostic, mobile responsive, and easily configurable using our HTML5 user interface design tool.

We make doing business in a highly regulated industry easier. Our compliance team considers operational implications and regulatory requirements when working with the product team to develop compliance functionality. We consult with financial institutions, other vendors, and regulators to understand the industry approach and provide you with the flexibility you need to minimize workflow impact when changes are required.

Aligning sales and marketing is essential to ensure both teams share goals, messaging, and effectively target customers.

Reverse mortgage lending has evolved into a product offering, enabling lenders to better address the needs of a broader range of borrowers.

Any lender can delve into reverse mortgages, indicating a shifting landscape where both senior homeowners and lenders stand to gain